Car Loan Salary Requirements Malaysia

Once the application and documents are submitted it is up to the bank to decide on the approval of. In this example you select Maybank Hire Purchase to finance your car purchase.

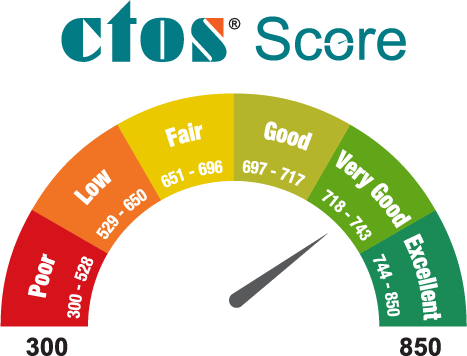

Car Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

RM1000 RM4500 x 100 22.

. The interest rate is priced at 340 annually and you can extend the repayment period for as long as 9 years. To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application. Total monthly commitments.

Individuals applying for a car loan must be at least 18 years old at the application date. The final financing details will be reflected on the Hire Purchase or Hire Purchase-i Agreement. Below is a summarised diagram of a typical car loan application process in Malaysia.

The car loan application process. In Malaysia today car loan tenures are usually of 57 or even 9 years with interest rates hovering around 3 per annum calculated on principal. Upon completion the online car loan calculator in Malaysia would generate a list of available car loan packages fitting your requirements starting with the ones with the best rates at the top.

But as per Tip 1 this does not take into consideration all expenses incurred when buying a car. In general national and second-hand cars have higher interest rates. Alliance Bank Hire Purchase.

Applicants with a salary of RM2k RM3k can be guaranteed by parents who have a household income of at least RM5k. CIMB Maybank and Public all offer home loans to expats up to 90 also subject to the banks decision. Set Recurring select Effective Start End Dates if you want your payment to be automatically deducted on a monthly basis for subsequent months.

Key in Amount and Effective Payment Date. AmBank Arif Hire Purchase-i. With the exception of boat or bike loans the loan amount should be rounded to the lower hundred ringgit amount.

With a valid visa and a decent credit rating most expats are able to get loans from a Malaysian bank. Select Maybank Hire Purchase. Most bank takes a few days to complete the process.

If youve been planning to buy a car and apply for a car loan in Malaysia youll be well-advised to make the purchase before the Sales and Services Tax SST comes into force on September 1. The figure below illustrates rough monthly expenses if we pay RM900 a. Procedure To Appy Loan To Buy A Car in Malaysia is a bit complicated.

By clicking on fixed rate or variable rate tabs below the calculator you can switch between the two major categories of car loans. A government employee civil servant. 3 months pay slip.

To make it easier for you refer to your car seller about the Loan approval for hire purchace agreement and car registration. When you buy a car the salesman will try to take care of everything for you. To illustrate further see the car loan.

A loan is paid off over time and in Malaysia you can take out a car loan for a minimum of one year to a maximum of nine years. The maximum value of a car that can be purchased is RM 6750 based on the calculation of vehicle loans. Interest rates apply to all types of loans and naturally car loans are no exception.

Bank Name Car Loan Interest Rates. Generally in East MalaysiaSabah and Sarawak the property residential or commercial must be at least RM300000 and RM500000 minimum in the peninsuladepending on your Malaysia My Second Home MM2H status. Select Pay Transfer.

You can check the latest plate number. For an expat to apply for a loan they should make sure they have these documents. Paycheck stubs from the previous 3 months.

This however is subjective as each bank has different requirements so its best to check with. To be eligible you need to meet all these requirements. RM500 car loan RM200 PTPTN RM300 credit card RM1000.

Individuals must be Malaysian citizens. Any salary earning individuals self-employed individuals public listed companies private limited companies sole proprietorships and partnerships can apply. Documents that you will need include.

Fast processing time. The financing illustrations on the financing calculator is only an indicative. The requirements are similar to those of a loan from an American institution.

Car prices are expected to increase and be higher than the GST price by approximately 2 to 3. This means that they will obtain the documents from you and then send it to the bank. You must have Driving License Pay slip and Guarantor to get better interest rate for car loan in Malaysia.

When applying for a loan banks will only allow you to borrow up to a certain amount of your DSR. The salary is RM900 per month and 15 of the salary is RM135 per month. If its RM55000 an approved loan is RM55000.

For the purchase of a new car Maybank is offering up to 90 margin of finance with you covering the remaining 10. The rates set for car loans are partly based on 2 main vehicle-related factors firstly if it is a national or foreign-made brand and second if it is a new or used car. - If its RM65000 - an approved loan is RM59900.

The eligibility criteria of a car loan are as follows. In 1949 the loan tenure for a VW Beetle was 12 months with an interest rate of 9 per annum. For example to buy a car with a net worth of RM59993 the officer has a maximum loan eligibility of.

How Much Salary To Buy A House In Kl Malaysia Comparehero

What Car Can You Really Afford With Rm 5 000 Monthly Salary

A Guide To Car Loans Interest Rates In Malaysia

Salary Below Rm3000 Here Is A List Of The 5 Cheapest Car Models With The Best Fuel Consumption Tips Caricarz

Salary Below Rm3000 Here Is A List Of The 5 Cheapest Car Models With The Best Fuel Consumption Tips Caricarz

0 Response to "Car Loan Salary Requirements Malaysia"

Post a Comment